Once we recognise the practicality of a fixed-term annuity as a superior form of fixed-income exposure for retirement income portfolios compared to a bond fund, it becomes clear and straightforward how to integrate them into a client’s portfolio in place of “bonds”.

The most straightforward implementation is to take the asset allocation that matches the investor’s attitude to risk (say 40% equity and 60% bonds) and replace the bond exposure with a fixed-term annuity. We allocate the other part to an equity portfolio.

The investor takes an income from both parts of the portfolio:

- The fixed-term annuity pays out a regular amount

- The investor can withdraw an amount from the equity part. For simplicity, let’s assume this is a fixed amount equal to 4% of the amount they allocated to equities on day one.

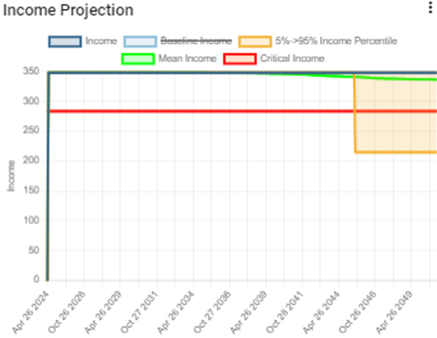

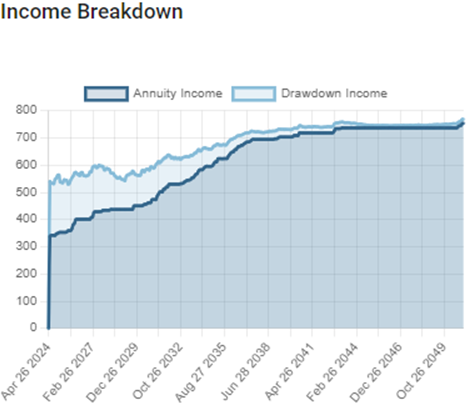

The charts below serve as visual aids to illustrate the potential outcomes of our strategy. We have based our analysis on our “normal” investor (a 67-year-old man retiring now with £100,000). Chart 1 demonstrates how the income from this strategy may evolve. Most of the time, the investor receives the income from the fixed-term annuity plus the 4% of the initial value allocated to the equity pot. There is a slight chance that the value of the equity pot will fall to zero and this income stream will stop. However, as we have shown, if we use 4%, this is a rare event that will only happen if the investor lives for a long time. Our analysis suggests a 5% chance of failure in twenty years when the investor is 87 years old.

Chart 1

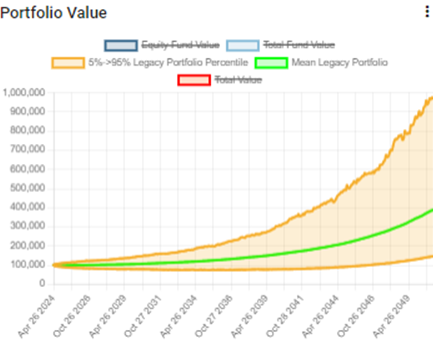

On the flip side, this strategy offers a significant legacy. Chart 2 illustrates the potential legacy benefits.

Chart 2

Our analysis shows that the present value of the income received is about 55% of the income from an annuity and that the present value of the mortality adjusted legacy portfolio is about £110,000. (the chart shows how the legacy value can grow if the investor lives a very long term. When we calculate the average legacy value take into account the chance of mortality and calculate the value today using prevailing interest rates). In this case, because the investor’s estate receives the total residual value of the fixed-term annuity, the average residual value hardly dips below £100,000.

Investor preferences

The raw numbers are a great starting point, but we need more information about the investor’s preferences to identify a client’s best retirement income strategy.

- What is flexibility worth to them?

- How important is it that they receive the maximum income?

- How concerned would they be if their income fell below their Critical Income?

- What value do they put on the legacy they leave?

As is common in other areas of financial planning, we stress the importance of understanding investors’ preferences for income, flexibility, and leaving a legacy. Once we have a comprehensive understanding of the investor’s profile, we can quantify the pros and cons of any retirement income strategy and create a score for it. This process of scoring strategies means we can rank them and identify the best strategy for an investor, making them feel valued and integral to the decision-making process.

Workplace schemes and other pension providers that want to offer retirement income solutions for a cohort of clients can survey their client base to learn their preferences. A survey is likely to reveal different groups of people with similar preferences. The trustees can then use these profiles to create an appropriate range of retirement income strategies.

Although the broad requirements of the FCA regulations to identify a client’s attitude to risk and capacity for loss remain pertinent, the appropriateness and suitability questions that advisers use to determine an investor’s profile when they are saving are redundant when the investor moves to the part of their life when they are taking money from their assets. The volatility of a client’s assets is not relevant. Instead, clients are concerned about variations in the income they may receive. The requirement to afford their needs replaces the monetary loss calculation when calculating a client’s capacity for loss.

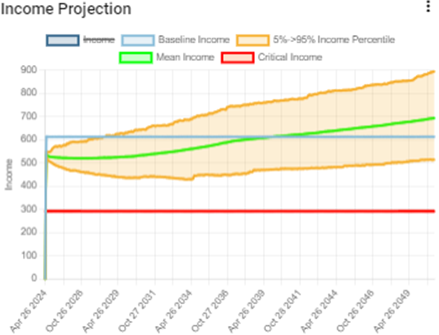

Chart 3

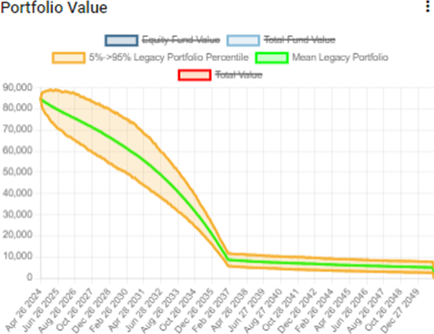

Chart 4 below shows how the flexibility/legacy value declines over time due to the glide path.

Chart 4

- The starting income is similar to an annuity.

- The allocation to the annuity rises steadily over time, and as it does, the income paid to the client exceeds the annuity they could have bought.

- The average income increases steadily over time, offsetting inflation.

- The estate value remains positive but not excessive.

It’s interesting to look at the income from a single simulation. Chart 5 shows the income from the annuity and the equity portfolio.

Chart 5

Most of the income comes from the annuity. The annuity income only ever increases; it never falls. The equity income is more variable. Over time, the income from the annuity dominates. This is because of the glide path and the mechanism whereby equity gains and higher annuity rates will cause the client to buy more.

Our analysis shows that the present value of the income received is about 90% of the income from an annuity and that the present value of the legacy portfolio is about £16,000. We use a weight that we derive for the investor’s preferences to give the income and legacy/flexibility a score for what this feels like for the investor.

- The income has a score of 86

- The legacy value scores 7

The strategy is a better fit for this investor than the static version.

Conclusion

In conclusion, integrating fixed-term annuities into retirement income portfolios offers a compelling solution for mitigating sequence risk and providing stable cash flow.

Through dynamic strategies tailored to investor preferences, financial professionals can empower clients with personalised retirement plans that optimise income and legacy objectives.

By replacing traditional bond allocations with fixed-term annuities, investors can enjoy a steady income stream while maintaining exposure to equities for potential growth. The flexibility inherent in these strategies allows for adjustments over time, ensuring that income needs are met while preserving legacy goals.

Through careful analysis and scoring of different strategies, financial advisors can guide clients towards the most suitable retirement income plan, considering individual preferences for income stability, flexibility, and legacy preservation.

The SPERO® retirement income analysis tool provides valuable insights into the value of different retirement income strategies and the effectiveness of dynamic changes, allowing for informed decision-making and ongoing optimisation of retirement strategies.

Overall, the ability to tailor retirement income solutions to investor preferences represents a significant advancement in financial planning. With the means to assess and score dynamic strategies, clients and advisors can confidently navigate retirement, knowing that their plan is aligned with their unique goals and circumstances.